Our Blog - Subject 3 |

(3) Calculation of the optimal investment |

|

Blog index | ||

|

|

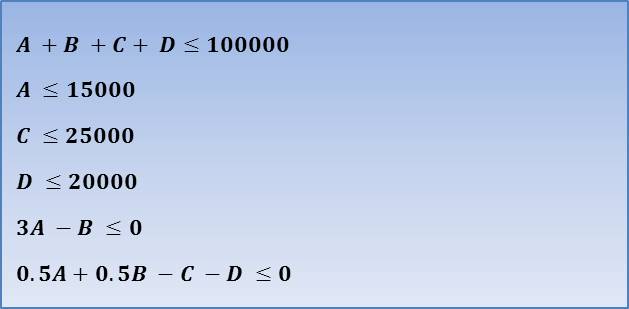

We raise the problem and find the solution ... |

|

|

|

|

|

|

|

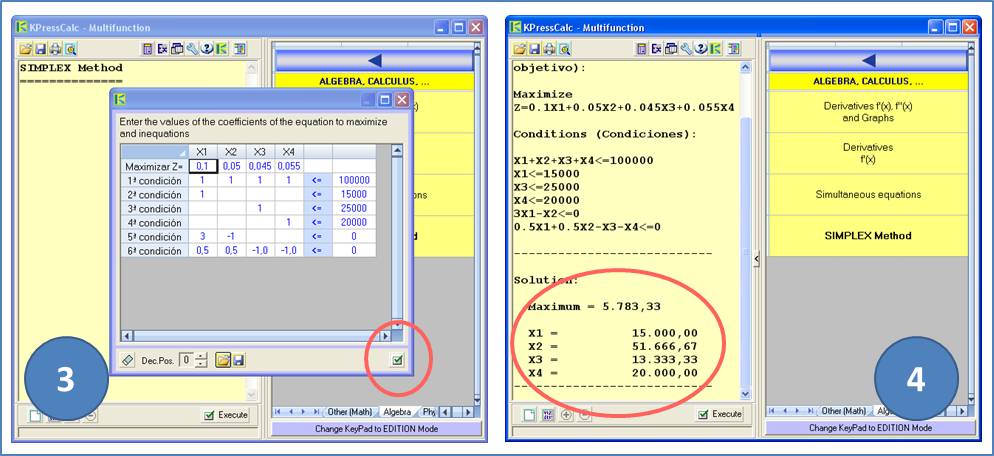

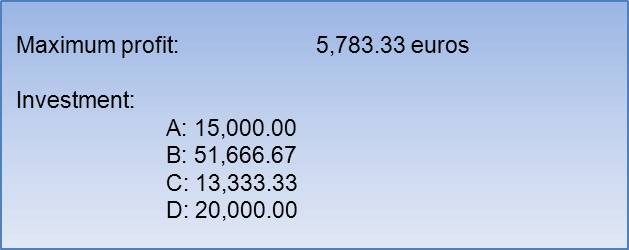

... and now we solve it automatically ... |

|

We have used the possibilities that KPress-Calc gives us to implement the Simplex method. KPress-Calc is a fully free tool that allows us to make any calculations, either from an administrative, financial or scientific point of view, but mostly it gives users the ability to create their own programs or processes, not depending on third parties.

You can download KPress-Calc and try the Simplex method for any linear programming problem. At the top of this page you can have access to a video tutorial in which you can see the result of the proposed problem by using KPress-Calc and, in any case, below we show in pictures the process to obtain the solution:

|

|

|

|

|

|

|

Join in and test the different processes that come with KPress-Calc, for example, within the Economics area are implemented processes that allow us to obtain many caculations immediately: DDB, IRR, MIRR, VA, VNA, VF, NPer, PV , NPV, SLN, SYD, ... you can also create your own processes and, if you like, share them with the community of users in KPress-Calc.

|

|

If you are a member of Linkedin you can share this article using the attached button. |

|

Go to top |

|

|

Comments area |

|

|

|

|

|

|

|

|

|

|